As EV battery technologies continue to develop rapidly, investors in charging stations have raised concerns about the potential obsolescence of their charging hardware. If we install a charger even with the 350kW of capacity, how long will that charger be competitive in the market? In this article, we will address how charging speeds will likely evolve over the next 5-10 years and the implications for charging infrastructure investors, given the intricacies of charging curves, OEM battery roadmaps, and customer behaviors and preferences.

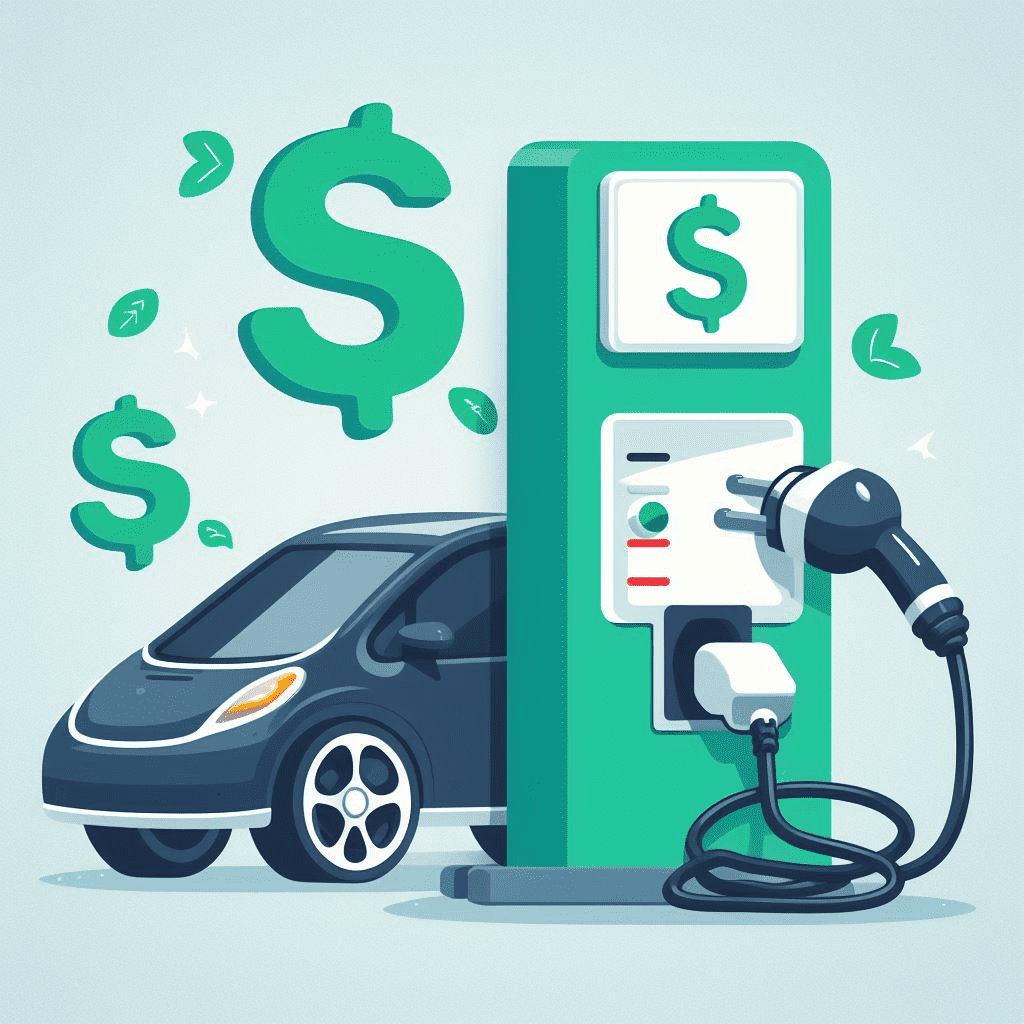

Charging Curve

Currently, at high charging powers (> 50kW), all EV batteries have a non-linear charging curve imposed by the battery management system (with the primary goal of preserving the state of health of the battery) – power increases rapidly within the first 10% of State of Charge (SoC), peaks between 10% to around 30% SoC, decreases until it reaches around 50kW at around 80%, and diminishes to 0kW as SoC approaches 100%. The specific shape of the curve between these points may vary, but the broad envelope and trends remain similar across OEMs and models. This curve is shown below in red (see Figure 1).

Battery experts with whom we have interacted generally agree that the path of least resistance to increasing charging speeds is through flattening the curve by extending the duration of charge time at or near the peak, rather than racing to increase overall charging power.

With more thermally conductive cell/module materials, and better battery management systems that can control the charging and discharging of the battery at a more granular level (i.e., cell-based or groups of cells), the shape of the charging curve will move towards the blue curve. The blue charging curve (Figure 1) reaches the peak charging power more slowly, i.e., ~ 20% SoC, and stays at the peak charging power for longer, i.e., until ~50-60% SoC, before the charging power reduces to 50kW at 80%. Our experts believe this blue curve is expected to become widespread by 2028.

Further active thermal control of batteries (e.g., with an active fluid loop), combined with better BMS systems and enabled by LFP (Lithium Iron Phosphate) chemistries, will trend toward the green charging curve (Figure 1). The green charging curve reaches peak power at the same SoC as the red charging curve (i.e., ~10%), while maintaining peak power for as long as the blue charging curve (i.e., 50-60%). This charging profile leads to the highest average charging speeds and the lowest charging times for any given charger and battery. However, active thermal control of the battery will be essential to achieve this in the future.

Active thermal control is a vital tool for extending battery lifetime. There are two overarching mechanisms for battery degradation, one that dominates at low temperatures, and one that dominates at high temperatures:

- Below 25C, the dominant degradation mechanism is lithium plating on the anode. Anodes today are made of graphite, whose equilibrium potential is the same as the reversible potential of lithium solution/dissolution. At low temperatures, or during fast charging, when the rate of intercalation of lithium ions into the anode is lower than the rate of transport of lithium ions to the surface of the anode, the lithium ions pile up on the surface of the anode, and cause plating. In severe cases, this causes lithium dendrite formation, which can pierce the separator and cause a short circuit.

- Between 25-60C, the dominant degradation mode is SEI growth on the anode (SEI is solid electrolyte interphase, electrolyte degradation products settling on the anode, forming a solid layer). Heat increases the rate of reaction of electrolyte degradation and the rate of SEI growth.

- The optimal temperature for a lithium-ion battery cell is around 25C, when the rate of lithium plating is the lowest, and the rate of SEI growth is the lowest. This requires both removing heat (especially later in the charging cycle) and adding heat where needed (e.g., at the commencement of charging, particularly in cold temperatures) to create thermal uniformity across and within battery cells:

- Joule heating can increase battery temperature, so an effective method for decreasing battery temperature must be established to reduce battery SEI growth. However, at low temperatures, the battery may need to be heated to an optimal temperature to prevent plating and dendrite formation.

- Battery cells can also have spatially non-uniform temperatures inside the cell, arising from the feedback loop between local transient high temperature and reaction rates (Arrhenius equation), which creates further high temperatures inside the cell. The cathode, which lies farther in the interior of the 4680 cylindrical cell, heats up more than the anode, which lies on the exterior.

Active thermal control mechanisms include circulating a heat-conducting fluid within the battery pack and/or surrounding the battery cells with a material that can change phase.

Figure 1. Various battery charging curves

Battery Roadmap

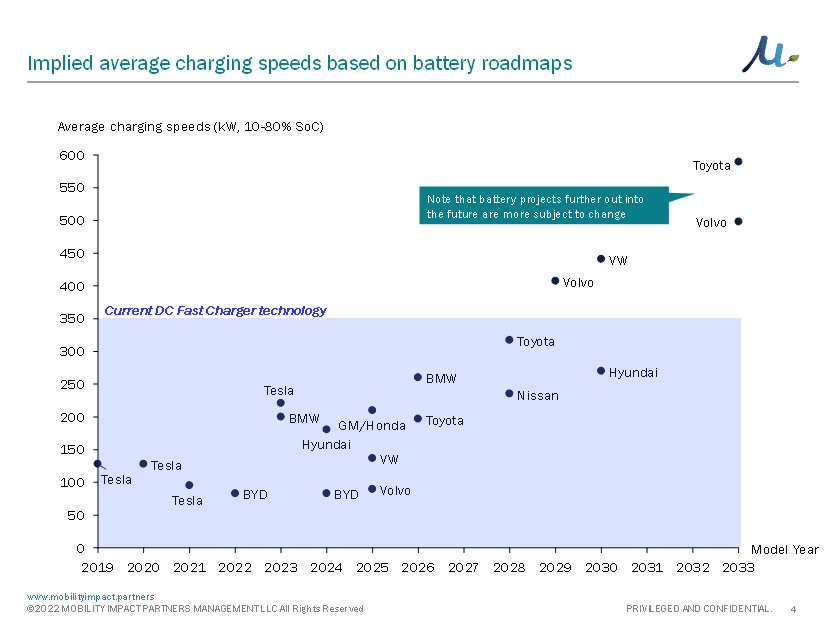

To better understand optimal future charging speeds, it is helpful to understand automotive OEMs’ publicly released battery roadmaps and future battery specs. Based on statements from leading OEMs, average charging speeds during the charging cycle will exceed 350kW (the current highest widespread DC Fast charging speed) for the first time in 2029 (see Figure 2). It should be noted that the average charging speed is not the maximum charging speed that can be reached in the charging cycle. Maximum charging speed is what determines the speed of the charging hardware.

It should also be noted that moving from 350kW to charging powers of 600kW-1MW will double or triple the cable weight, making it difficult for consumers to lift the charging cable and insert the connector. It is also unlikely that grids can support these charging powers outside of truck charging stations, where distribution infrastructure will need to be upgraded to handle high power loads.

Figure 2. Average charging rate implied by OEM public statements

Even if such high charging rates were widely feasible, let’s closely examine the corresponding charging time. The consumer ultimately cares less about the charger speed specs at a particular charging station and more about the time it will take to charge the EV. If we assume for a moment that given a wide variety of substitutes, customers in the future will choose the charging station that requires the least time for charging, the question becomes: when will the difference in charging times at a 350kW charging station and a higher power charging station become noticeable to the customer?

We tried to answer this question in two ways – by looking at the time it takes for an EV to charge from 10-80% SoC and the time it takes for an EV to add 100 miles in range.

When we evaluated the time it takes for an EV to charge from 10-80% SoC, assuming that there are no fundamental constraints in creating and installing high-power charging infrastructure, and we considered the publicly released battery roadmaps from leading OEMs as well as the progression of the charging curve from the red to blue curve in 2028, we saw that the deficiencies of the 350kW charger become significant in model year 2026 EVs onward for certain OEMs. Specifically, the charging time differences are substantial for BMW EVs model year 2026 onward, Toyota EVs model year 2028 onward, Volvo EVs model year 2029 onward, Hyundai EVs model year 2030 onward, and VW EVs model year 2030 onward. The same pattern emerges when we evaluate the time it takes for an EV to add 100 miles in range. In both cases, our analysis shows that it takes between 20%-50% less time to charge if the charging power is unconstrained than if the maximum charging power were limited to 350kW.

Charging infrastructure investors should consider when the population of key EV OEM and model year combinations will be large enough that an investment in higher power chargers is warranted. Based on our market analysis, the market share of the aforementioned key EV OEM and model year combinations will become significant in 2030 in the US and Europe. In 2030, the share of key EV OEM and model year combinations as a percentage of all EVs on the road will be ~10% in the US and Europe, and these EVs will be responsible for 10-20% of the utilization at the average DC Fast Charging station (i.e., 1 in 10 to 1 in 5 EVs at an average DC Fast Charging station in the US or Europe will be one of these key OEM and model year combinations beginning in 2030). This leads us to believe that based on all publicly known information today, superannuation of 350kW charging infrastructure is likely not to be a problem for the next six years, but that charging infrastructure investors installing 350kW chargers today should conservatively aim to amortize their equipment investment by 2030 (6-7 years from now).

Customer Behavior and Segmentation

Charging station owners should also focus on non-hardware strategies that can result in differentiated utilization (e.g., siting, marketing reliability metrics to customers, partnerships with surrounding amenities, etc.) and/or start charging for auxiliary services that customers may value (e.g., the ability to reserve a charging station ahead of time). [Note that we have explored the topic of Charging Station profitability in detail in our Charging Infrastructure working group final report, which is available to our partners].

Charging infrastructure investors should carefully consider customer types and what customers are willing to pay for. At the risk of oversimplification, we found primarily two customer archetypes for DC Fast Charging – (A) customers who charge in urban centers because they have no other choice (i.e., they don’t have a charger at home or at work, they’re running out of charge, etc.), (B) customers between urban centers who stop to charge on longer trips.

- Customer surveys have found that customer segment A is willing to pay for proximity, reliability, and price – given alternatives, they choose chargers that are on-route to their destination, work reliably, and have low prices. ~20% of these customers are willing to wait for <5 minutes for their EV to be charged, 30% are willing to wait for 5-10 minutes, and another 30% are willing to wait for 10-20 minutes. 50% of these customers who enter the charging station leave without charging if the wait times are too long (a plurality of customers are not willing to wait more than 10 minutes to use a charger). Charging station owners catering to this customer segment have found that advertising reliability and wait times have led to an increase in utilization, e.g., a charging station saw a 20% increase in utilization after showing the highest reliability compared to benchmarks, and another charging station saw a 20% increase in utilization after providing a mobile “waitlist” for customers.

- Customer segment B is primarily attracted to amenities found on highway rest stops. These include convenience stores, food and coffee stores, lounge areas, clean bathrooms, and outside areas for stretching or exercising. Although this customer segment is accustomed to waiting for 30 min – 1 hour to charge their EVs, they prefer lower charging times. They are drawn to the combination of the amenity and the charging time and do not decide where to charge solely based on the fastest charging time.

Charging infrastructure investors targeting customer segment A should consider advertising the high reliability of the charging station and marketing the charging station location to attract customers. Those targeting customer segment B should consider promoting the quality of the amenities available in their rest stops. Investors should also remember that the marginal cost of installing high-power charging stations will be much lower at locations where distribution grid capacity is already available (e.g., at a charging station catering to trucks and large commercial EVs).

Another variable that charging infrastructure investors must consider is the charging behavior of customers (i.e., at what SoC customers come in to charge and when they leave). Studies have found that most customers come to the charging station at ~30% SoC, regardless of customer segment. Customer segment B usually charges up to ~80% SoC, and few customers in either segment charge more than 80%. For customer segment A, which is the customer segment for whom minor differences in charging speed are most important, one of the things charging infrastructure investors may want to study is whether customers in this segment leave within their preferred time window regardless of the end SoC or milage range, if they charge to a specific SoC (e.g., to 80% SoC), or if they charge to add a particular number of miles (e.g., 100 miles). If customers in this segment prefer only to add ~100 miles, it would mean that differences in charging times between 350kW chargers and higher power chargers will be less noticeable. Or suppose customer segment A ends their charging session when their preferred time window has elapsed (regardless of the miles added or end SoC) and is amenable to multiple charging sessions a week. In that case, an increase in charger speed may not impact their decision to use a particular charging station.

In short, we believe that the most important and currently least understood factor in planning for charging infrastructure is understanding the evolving behavior and preferences of the customer.

About MIP

MIP is a collaborative strategic investment firm that brings together the leading stakeholders in the mobility ecosystem — auto companies, parts suppliers, energy companies, fleet operators, logistics providers, technology and communications companies, financial and insurance companies, as well as cities and municipalities — to identify common challenges, find solutions, invest in those solutions, and then scale those innovations across the market