Key takeaways

Concerns around the supply of critical materials for EVs, such as lithium, have led to a race among automakers to secure supply.

Our analysis of the lithium market has shown that the world has sufficient lithium reserves to supply over 100 years of global lithium-ion battery demand.

Although our analysis indicates theoretical shortages starting in 2027, we expect new lithium projects to come online in the next four years to balance the market.

Current lithium raw material prices are well above the marginal cost of extraction, and we expect lithium prices to fall from their current elevated levels.

Downside risks to lithium supply include permitting issues, labor constraints, and difficulties bringing processing and refining capacity online.

Racing to secure lithium supply by partnering with mines and processors is a suboptimal use of automakers’ resources, as there is a risk of overpaying for lithium supply.

Automakers are racing to secure lithium supply — but is this the right move?

Lithium is one of the most critical minerals for EVs; a typical lithium-ion battery contains approximately 8 kg of lithium. Without sufficient lithium, the production of lithium-ion batteries for EVs would be significantly hindered, impacting the growth of the EV market. As the demand for EVs continues to grow, so does the need for a reliable and sustainable supply of lithium. This reasoning has led several OEMs to make investments in lithium mines to secure supply. It has even led some analysts to question the feasibility of the transition to electric vehicles based on the supposed scarcity of raw materials.

For example, in early 2023, GM announced plans to invest $650 million into Lithium Americas as part of an agreement to develop a mine in Nevada. Through this agreement, GM has secured the lithium required to build more than 1 million EVs annually in North America in 2025. Volvo is currently in advanced talks with several major miners over potential stakes in lithium mining or processing operations, while Tesla is reportedly considering an acquisition of Sigma Lithium.

However, investing in lithium mines may be an inefficient use of OEMs’ capital…

The world has sufficient lithium reserves to meet demand

Lithium is an ample resource. Our research on the lithium market has revealed significant global lithium reserves, enough to meet over 100 years of lithium-ion battery demand. Subsequent to our analysis, additional lithium reserves have been announced in India, adding another 6–8% to the above numbers. In contrast, today’s transportation industry relies on oil resources with proven reserves of ~50 years. Moreover, approximately 60% of known lithium resources are in countries that can trade relatively easily with demand centers in the US and Europe (e.g., Argentina, US, Canada, Mexico, Australia, Chile, and Western Europe).

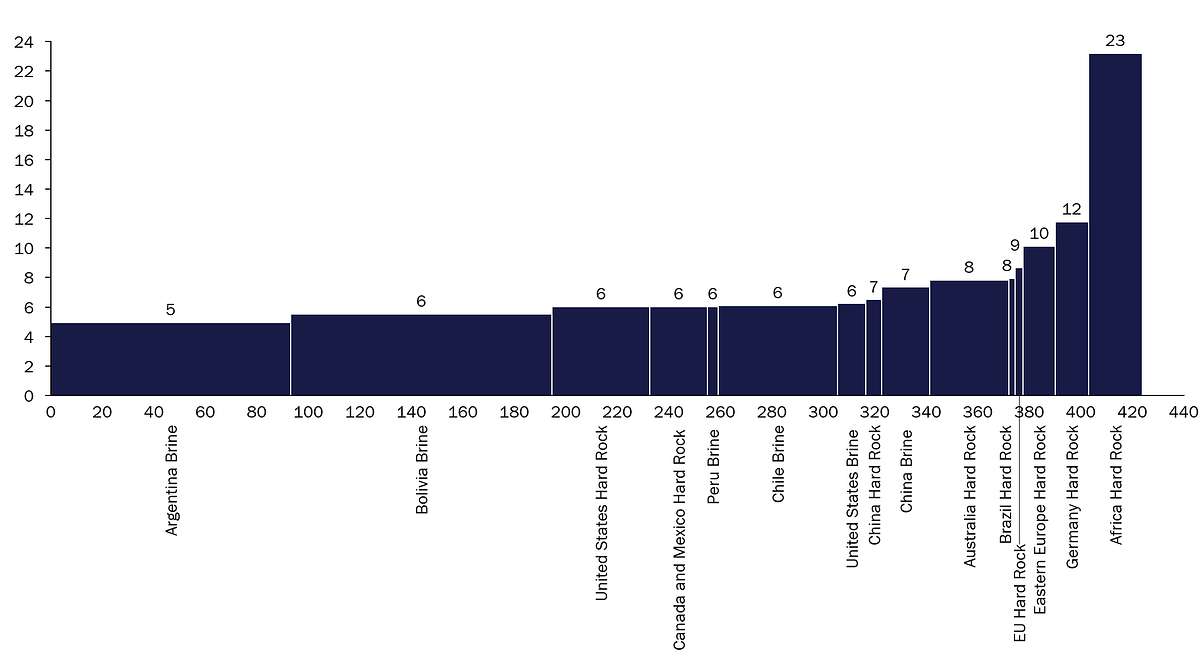

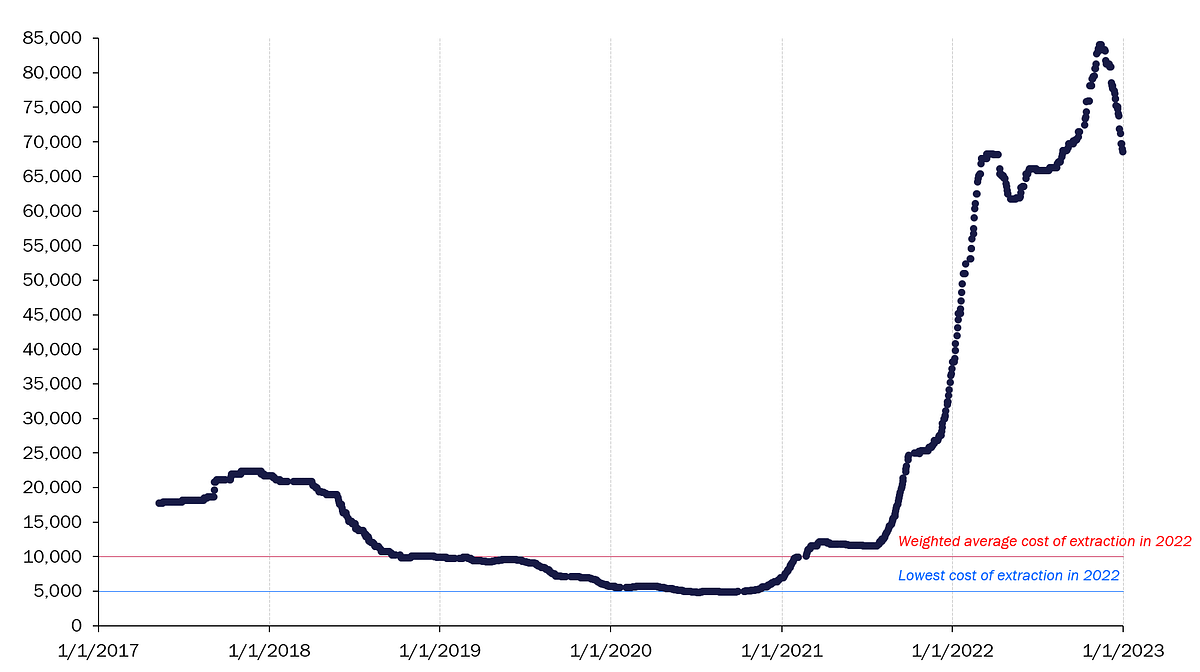

The marginal cost of lithium extraction is low, with 80% of global resources falling in the $5,000–8,000/metric ton LCE range. This is well below recent lithium prices of $50,000–85,000 per metric ton of LCE — a phenomenon that is unlikely to be sustainable.

New projects will balance the market and bring prices down

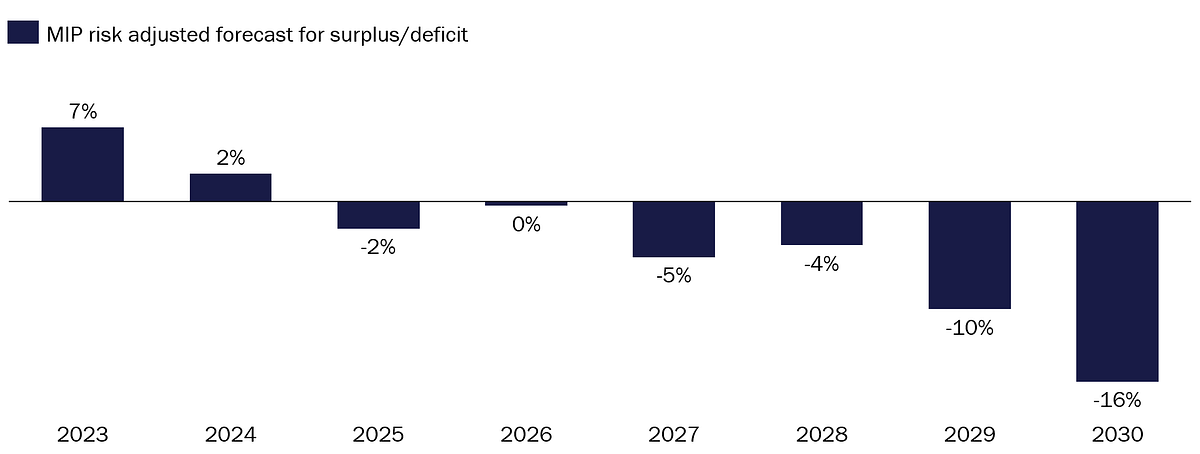

We developed a supply and demand forecast to understand the lithium market. We project that lithium demand will reach approximately 2,500 kilotons (kT) of lithium carbonate equivalent (LCE) annually by 2030, an increase from just over 900 kT today. This near-tripling of demand is driven primarily by the electric vehicle industry. Meanwhile, we project lithium supply to reach 2,100 kT of LCE in 2030 based on current production capacity, new mining project announcements, and planned mine expansions.

Our analysis shows a balanced lithium market in the near term, with theoretical shortages starting in 2027. However, we expect readily available project financing (driven by long-term offtake agreements and the spread between the costs of extraction and prices of long-term offtake arrangements) to drive a strong supply response, resulting in more reserves being mined over the next few years. We predict that new lithium supply will balance the demand between 2027–2030, but the market may see continued price volatility because of the significant disparity between supply costs and spot prices.

Lithium price volatility may have incentivized recent moves by automakers to secure supply. Lithium carbonate has ballooned in price from ~$18K/metric ton in 2017 to ~$70K today. We expect a more balanced lithium market to drive prices down from their currently elevated levels over the next few years.

We see downside risks to lithium supply

Labor constraints in mines, difficulties bringing on process and refining capacity due to the lack of technical expertise outside of China, and potential delays in permitting have been cited as risks for the lithium supply chain. We agree, but the tremendous profitability of lithium production will likely drive an influx of talent and capacity. These factors should, at most, result in short-term supply disruptions.

Conclusion

Given the low cost of extraction and the widespread availability of lithium, investments by automakers in mining may be misplaced. While securing a reliable supply chain is essential, automakers may find themselves overpaying for lithium if they lock in supply contracts at current market prices. Furthermore, the availability of significant lithium reserves globally and the low marginal cost of lithium extraction indicate that the lithium market will likely be balanced over the medium and long term.

About the authors

Asad Hussain is the Partner of Research at MIP. Asad previously led PitchBook’s research coverage of the mobility sector, and his research has been featured in several premier media outlets.

Cassidy Shell is a Senior Associate of Strategy & Research at MIP. Cassidy was previously a Senior Associate at the Cleantech Group, where she focused on mobility and sustainability research.

Shweta (Shay) Natarajan is the Partner of Strategy at MIP. Shay has previously held strategy leadership roles at Caterpillar, McKinsey & Co., and Apple.

All authors have equal contributions and are listed alphabetically by first name.

Mobility Impact Partners (MIP) is an ESG-focused private equity fund that collaborates with corporate LPs and city partners to solve the most pressing challenges in the transportation and mobility landscape.